December 2021

Co-founder and CPO, AMMP Technologies

Share post:

PV and battery storage markets around the globe are on the rise. There is an increasing number of companies owning or operating large energy portfolios.

A key characteristic of these portfolios is that they consist of:

a) A variety of different system technologies (PV, metering, batteries, etc.)

b) Technologies by various OEMs (SolarEdge, Huawei, SMA, Fronius, Delta, SunGrow, etc.)

c) Varying use cases (captive power, net metering, leasing, PPAs, community solar, etc.)

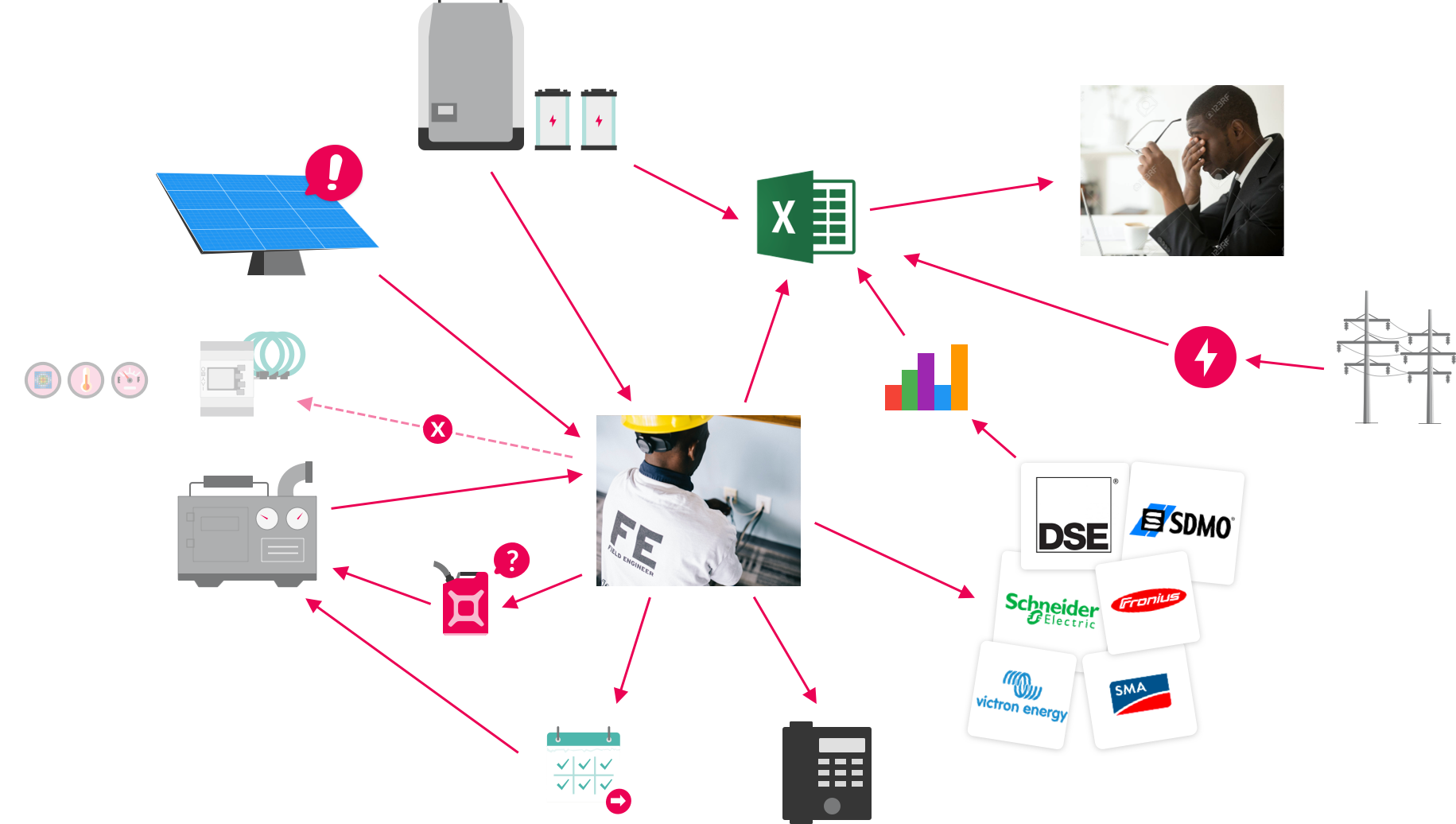

Due to this diversity across portfolios, many operators end up with fragmented monitoring of their systems. This often involves making use of multiple OEM monitoring portals. Since these portals are quite distinct, we will call them “operational data silos” going forward.

An owner or operator of a portfolio of 50 energy systems typically deals with at least 10 data silos. Any addition of new systems or technologies increases this number further. Such a fragmented situation comes with downsides that are often overlooked. Four of these hidden costs are presented below.

If operational data is spread over many data silos, it is difficult to extract the most important information or connect the dots. An operator monitoring batteries, PV, and consumption separately, will eventually miss performance issues.

They will miss unexpected changes in customer consumption, unwanted grid feed-in, or unplanned solar curtailments.

Having several data silos typically also means dealing with multiple different notification systems. Operators need to juggle all notifications that might not be useful in isolation. A lot of them only make sense if combined intelligently.

Owners and operators must create reports for internal and external stakeholders. Most of the reporting is done regularly; e.g. on a daily, weekly, or monthly basis.

Finance teams need the latest energy data for billing purposes. Engineers need performance overviews. Management needs to know whether energy production meets expectations and forecasts. Investors want confidence in the company’s execution. End customers want to see accurate overviews of their consumption and their savings.

If operational data is distributed across multiple silos, gathering the underlying data takes a long time.

Reporting involves the following steps:

Reporting involves the following steps:

In the past, investors in renewable projects focused on the “low hanging fruit” in the market: they invested in a small number of large-scale projects. Meanwhile, sub-megawatt projects were of little interest. However, PV costs came down and new financing instruments emerged. Portfolios of medium-sized PV systems are attracting strong investor interest.

Most investors have realized the problems associated with fragmented PV portfolio management. They now demand centralized asset management as part of their technical due diligence. Increasingly often, they even expect access to the monitoring software as part of their oversight needs. This is impossible if you operate with data silos.

Most investors have realized the problems associated with fragmented PV portfolio management. They now demand centralized asset management as part of their technical due diligence. Increasingly often, they even expect access to the monitoring software as part of their oversight needs. This is impossible if you operate with data silos.

for calculating customer savings uses a different set of energy readings than the colleague for billing. Different departments create their own data silos on top of the operational data. This leads to uncertainty as to which dataset is the right one. Such inconsistencies will pile up and are almost impossible to trace down subsequently.

for calculating customer savings uses a different set of energy readings than the colleague for billing. Different departments create their own data silos on top of the operational data. This leads to uncertainty as to which dataset is the right one. Such inconsistencies will pile up and are almost impossible to trace down subsequently.The energy world becomes increasingly decentralized. Large portfolios of energy systems emerge. These systems need to be operated from a technical and a commercial perspective. Owners and operators should make conscious and informed decisions on how they want to set up their operational data. Not thinking this through will lead to data silos. This situation comes at costs that should not be underestimated.

AMMP Technologies B.V.

Papaverweg 34

1032 KJ Amsterdam

English

© 2025 AMMP Technologies Privacy & Terms